Contents

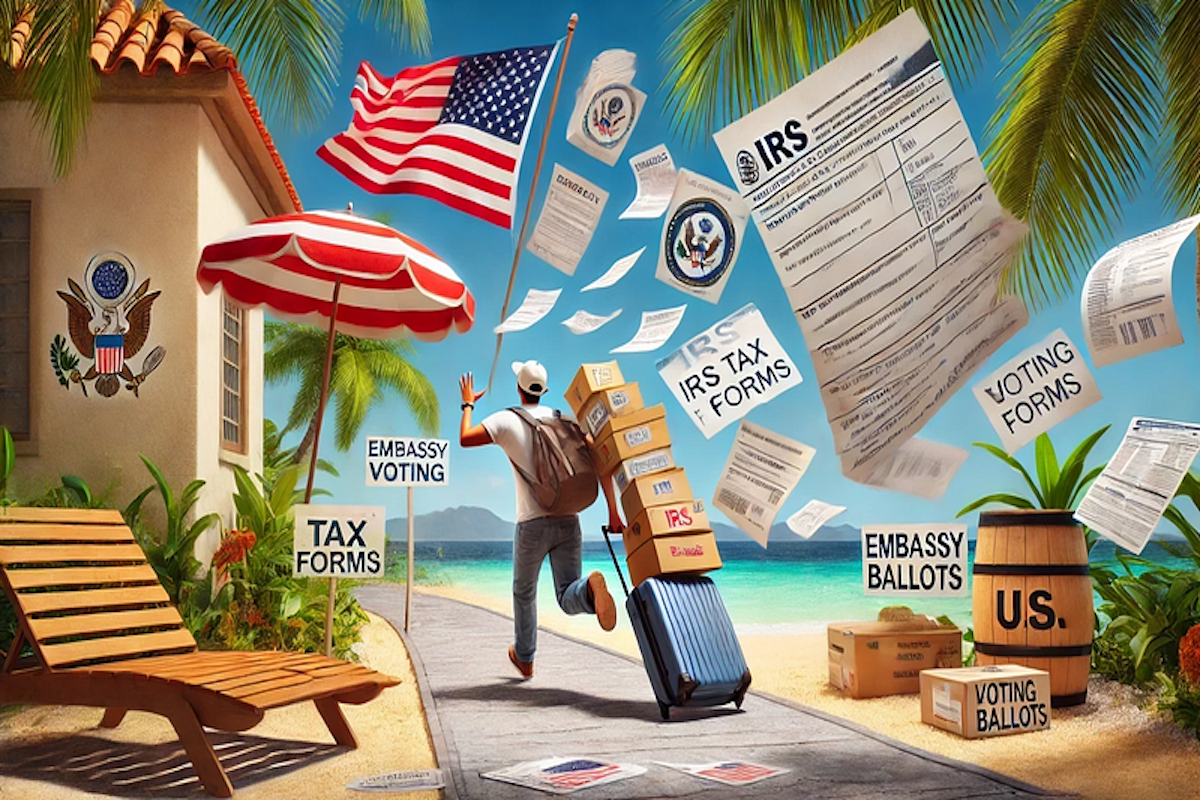

Think you’ve escaped Uncle Sam’s grasp by moving abroad? Think again! Here’s how taxes, embassy drama, and U.S. laws follow you across borders, and what you “must” do to survive.

Disclaimer: This article provides general information about U.S. policies affecting Americans abroad and is not intended as legal, financial, or tax advice. Always consult a professional advisor for guidance specific to your situation.

Thinking about moving abroad to escape U.S. taxes, laws, and that “constant” stream of political or culture war drama? Think again!

Spoiler alert: the U.S. will still find you.

That’s right, no matter how far you run, Uncle Sam has a way of creeping back into your life.

Whether it’s surprise tax bills, embassy nightmares, or trying to vote from the middle of nowhere, being an American abroad comes with more strings attached than a marionette.

But don’t panic just yet, keep reading to find out how to dodge the worst of it and keep your sanity.

Up first? The IRS, that ex who “really” can’t take a hint…

1. When You Move Abroad, U.S. Taxes Follow Like a Bad Ex

So, you’ve made the big leap, packed your bags, said goodbye to overpriced healthcare, and set off for greener (and probably cheaper) pastures.

But guess what?

The IRS is like that clingy ex who just won’t let go. Unlike most countries, the U.S. demands its cut no matter where you are in the world.

You might already be paying taxes in your new home, but the U.S. still expects you to file your tax returns, and yes, potentially pay them, too.

The “Foreign Earned Income Exclusion (FEIE)” helps, but don’t get too excited, it’s not as simple as waving your earnings goodbye.

Think more like a maze of paperwork and headaches.

Spoiler Alert: You “could” end up paying taxes twice.

But fear not!

Up next: the embassy you thought would have your back… but probably doesn’t.

2. The U.S. Embassy: Your Backup Plan…Until You Actually Need It

We’ve all seen the movies where the U.S. embassy swoops in to save the day. Real life? Not so much.

Unless you’ve got an appointment, and no, “I’m in trouble” doesn’t count as an appointment, you’ll find yourself dealing with some major red tape.

Passports? Sure. Anything else?

Well, let’s just say you’re better off Googling local help.

The truth is, the embassy staff probably won’t be thrilled to see you roll up with your problems.

They’re busy dealing with international relations, not bailing you out in Bali.

And don’t even think about evacuation during a disaster, yeah, you’ll get out, but you may get a big fat bill following you home too.

What’s Next?: Stick around to find out why voting from abroad is like trying to win the lottery…with a broken ticket machine.

3. Voting Abroad: Easier Than Herding Cats (But Just Barely)

You’re a proud American, and you want to vote! Good for you, now get ready for some serious hoops.

Absentee voting from abroad sounds simple, but between state-specific rules and international postal systems that move slower than molasses, it’s enough to make you give up altogether. Many do.

But hey, there’s hope! If you plan early, double-check everything, and use the “Federal Voting Assistance Program (FVAP)”, you just might succeed in casting that vote.

Let’s be real, though, by the time your ballot arrives, it might feel like the election was already decided. Thank God!

What’s Even More Fun Than Voting?

Banking abroad as a U.S. citizen!

Keep reading to discover how your passport could be your financial downfall!

4. Opening a Foreign Bank Account? Not So Fast, Yank!

You’d think opening a bank account would be the least of your worries once you’ve settled in abroad.

But if you’re a U.S. citizen, many foreign banks want nothing to do with you. Why?

Because thanks to U.S. regulations like “FATCA” and “FBAR”, there are treaties in place with most foreign countries that state their banks have to report everything about you and your account to Uncle Sam.

It’s easier for them to just say, “No thanks, move along Yank, we don’t need that kind of paperwork nightmare.”

So now, not only are you paying taxes back home, but you’re also struggling to even open a basic account in your new country.

But don’t worry, if you manage to navigate the red tape, you’ll get to keep detailed records of your finances for life. Fun, right?

Ready for More Bureaucracy?

Next up, we dive into the emotional rollercoaster of being tied to the U.S. and how to keep your sanity intact.

5. The Emotional Toll of Being Stuck Between Two Worlds

Just when you thought living abroad would mean leaving the U.S. behind, surprise, you’re still very much tethered to the land of fast food and endless paperwork.

Many expats feel stuck between their new lives and the constant demands from back home.

Whether it’s filing taxes, dealing with U.S. laws, or trying to explain to your new boss why their bank keeps rejecting you when you try to set up a direct deposit, it can feel like you’re constantly caught in the middle.

But here’s the real kicker: as much as you try to blend into your new country, there’s no escaping your American identity.

The good news? You’re not alone.

Join an expat group or forum, share war stories, and embrace the fact that you’re living the best (and occasionally most frustrating) of both worlds.

Ready for a Happier Ending?

Stick around to find out how you can thrive abroad, U.S. red tape and all.

Conclusion: How to Outsmart U.S. Policies and Live Your Best Life Abroad

Living abroad as an American is an adventure, no doubt.

But with taxes, embassy quirks, voting hassles, and banking nightmares, it’s essential to stay informed and ahead of the game.

The U.S. may have its claws in you, but with a little planning, you can dodge most of the stress and enjoy your new life abroad.

Bottom line! Do your homework!

Final Tip: Keep up with changes in U.S. regulations and find a good tax advisor.

And don’t forget to pack your patience, it’ll come in handy more than you think.

Have you had a run-in with U.S. policies abroad?

Let’s hear your wildest story in the comments, don’t worry, we’ve all been there!

David Peluchette is a Premium Ghostwriter/Travel and Tech Enthusiast. When David isn’t writing he enjoys traveling, learning new languages, fitness, hiking and going on long walks (did the 550 mile Camino de Santiago, not once but twice!), cooking, eating, reading and building niche websites with WordPress.